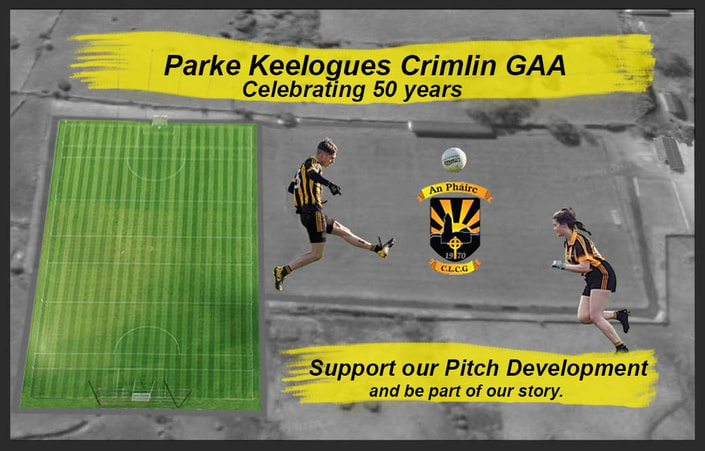

PKC GAA Pitch Development

This year, our fantastic club celebrates its 50th anniversary.

From the first steps onto Walter Durkan’s field to our current playing facilities, we have seen generations proudly wear the black and amber both here and abroad. But now, it’s our time to give back, to invest again in the future just like generations before us by developing a New Pitch to support the increasing demands on our current facilities.

If you or your family would like to make a donation to the development of the New Pitch facilities, please click on the Pitch Thermometer to make your contribution or use the other two payment options available.

Your support would be very much appreciated.

If you are able to make a contribution of €250, our club can claim tax relief (up to €167). Existing tax laws for sporting organisations allow our club to avail of tax benefits for approved projects. If an individual donates at least €250, an approved body can claim tax relief on the donation. For the club to claim the tax benefit, you will be required to provide your PPS number.

Investing now for future generations.

Martin McLoughlin

Chairperson

From the first steps onto Walter Durkan’s field to our current playing facilities, we have seen generations proudly wear the black and amber both here and abroad. But now, it’s our time to give back, to invest again in the future just like generations before us by developing a New Pitch to support the increasing demands on our current facilities.

If you or your family would like to make a donation to the development of the New Pitch facilities, please click on the Pitch Thermometer to make your contribution or use the other two payment options available.

Your support would be very much appreciated.

If you are able to make a contribution of €250, our club can claim tax relief (up to €167). Existing tax laws for sporting organisations allow our club to avail of tax benefits for approved projects. If an individual donates at least €250, an approved body can claim tax relief on the donation. For the club to claim the tax benefit, you will be required to provide your PPS number.

Investing now for future generations.

Martin McLoughlin

Chairperson

How do I contribute to the pitch development?

There are three options for contributing to the project:

1. Make an online contribution through the Visufund website

2. Transfer money directly through online banking.

3. Make a cash/cheque contribution.

Further details on each of the options are provided below.

If you have any further questions regarding the project or the payment options, please do not hesitate to contact PKC GAA .

Are my details safe and compliant with GDPR?

Your details are safe and in compliance with GDPR guidelines. To transact online, we are leveraging Stripe where your details will be encrypted.

There are three options for contributing to the project:

1. Make an online contribution through the Visufund website

2. Transfer money directly through online banking.

3. Make a cash/cheque contribution.

Further details on each of the options are provided below.

If you have any further questions regarding the project or the payment options, please do not hesitate to contact PKC GAA .

Are my details safe and compliant with GDPR?

Your details are safe and in compliance with GDPR guidelines. To transact online, we are leveraging Stripe where your details will be encrypted.

Payment Options

1. Make an online contribution

(a) Click on the thermometer below. This will transfer you to the website where you can donate to the pitch development.

(b) Click the 'Donate' button.

(c) Fill in the required details in order to make your contribution.

(d) Your online payment will be processed by Stripe.

(a) Click on the thermometer below. This will transfer you to the website where you can donate to the pitch development.

(b) Click the 'Donate' button.

(c) Fill in the required details in order to make your contribution.

(d) Your online payment will be processed by Stripe.

2. Transfer money directly through online banking

(a) If you wish to transfer money directly to PKC GAA through online banking, the details for the PKC GAA current account are as follows:

IBAN: IE93 ULSB 9854 2081 0141 89

BIC: ULSB IE 2D

(b) Please ensure to include your name as part of the transfer to allow PKC GAA to identify those who have generously contributed to the project.

(c) Finally, could you please fill out the following questionnaire to inform PKC GAA of your generous contribution. PKC GAA would like you to include your contact details in case they need to contact you regarding your contribution.

(a) If you wish to transfer money directly to PKC GAA through online banking, the details for the PKC GAA current account are as follows:

IBAN: IE93 ULSB 9854 2081 0141 89

BIC: ULSB IE 2D

(b) Please ensure to include your name as part of the transfer to allow PKC GAA to identify those who have generously contributed to the project.

(c) Finally, could you please fill out the following questionnaire to inform PKC GAA of your generous contribution. PKC GAA would like you to include your contact details in case they need to contact you regarding your contribution.

3. Make a cash/cheque contribution

(a) If you wish to make a cash/cheque contribution, please fill out the following questionnaire and a member of PKC GAA will contact you regarding your generous contribution.

(a) If you wish to make a cash/cheque contribution, please fill out the following questionnaire and a member of PKC GAA will contact you regarding your generous contribution.